ev tax credit 2022 cap

The Biden administration released a list of 21 EVs that qualify for the 7500 EV tax credit until the end of 2022 because their final assembly is in North America before the. If youre wealthy and you want to use the EV tax credit 2022 is the time to buy.

Auto Biggies Call For Removal Of Federal Ev Tax Credit Cap

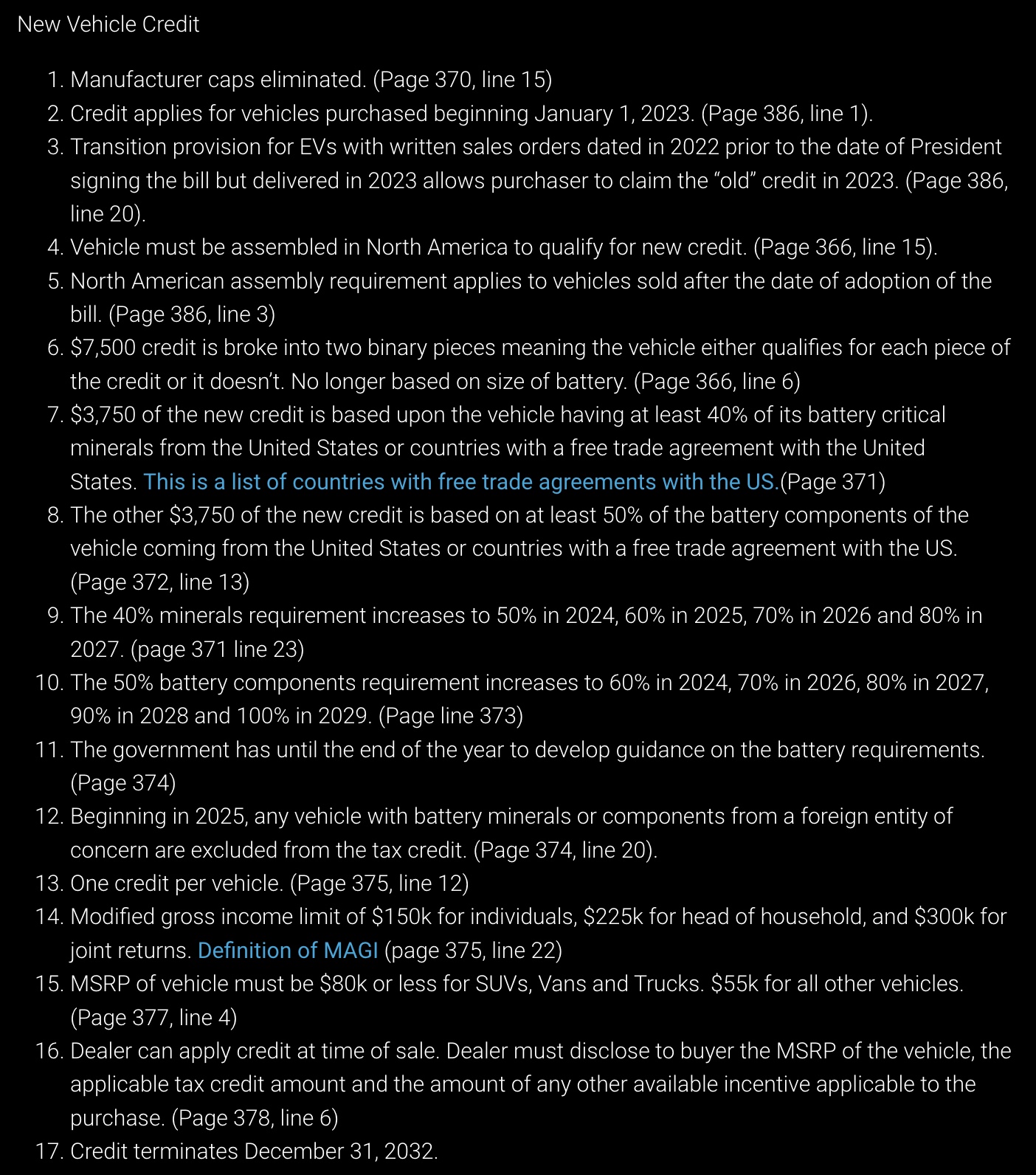

Theres now an income cap of 150000 for the modified adjusted gross income of individuals 225000 for heads of households and 300000 for joint tax filers.

. Toyota recently reached its cap in June 2022 and started phasing out its tax credits. 7th 2022 208 pm PT. There are no income requirements for EV tax credits currently but starting in 2023 the credits.

Toyotas EV credit will begin phasing out in Q4 2022 with a 50 credit for Q4 2022 Q1 2023 then 25 for Q2 Q3 2023. Buyers of electric or plug-in-hybrid Toyotas will have two quarters to take advantage of a 3750 tax credit after which it will again be halved to 1875 for another two quarters. 2022 Audi Q5 2022 BMW 3-series Plug-In 2022 BMW X5 2022 Chevrolet Bolt EUV - Manufacturer sales cap.

Electric vehicles are gaining popularity and market share. A complete guide to the new EV tax credit Step 1. In Q2 2022 EV sales accounted for 56 of the total auto market up from 27 in Q2 of 2021Clean energy and.

According to Automotive News the Biden Administration said on Tuesday that around 20 EV models will remain eligible for the 7500 EV credit through the end of 2022. Simply put the Inflation Reduction Act includes a 7500 tax credit at the point of sale for new EVs and 4000 for used EVs. The new IRA of 2022 bill also allows.

Where the EV is assembled matters For consumers buying a new model-year EV or PHEV start by determining whether. Again you wont currently find many options in that price range. For years the major automakers have argued.

The income caps are much lower for used EVs and the purchase price must be 25000 or less. Additionally the credit would be unavailable to single tax filers with modified adjusted gross income above 150000. For SUVs trucks and vans that price cap would be 80000.

The credit covers up to 30 of the purchase price and is capped at a maximum of 4000. First and foremost for EVs placed into service after December 31 2022 the. Toyota recently met the 200000 cap in Q2 2022.

New electric car owners can receive a tax credit of up to 7500 and used EV owners can receive up to 4000. The tax credit of up to 7500 on the purchase of a zero emissions vehicle could also be combined with other local incentives. If you were in contract prior to the law you can use the old law to get the EV credit if you are buying a vehicle with outside the US assembly.

For couples the cap would be 300000 combined income. Toyota sold its 200000th plug-in electric vehicle in the US triggering a slow phaseout of the federal EV tax credit over the next 15 months according to Bloomberg. Toyota said in April it expected its.

GM reached the 200000 vehicle cap in the final quarter of 2018 boosted by sales of the hybrid Volt sedan and fully-electric Chevy Bolt EV. Some vehicles will not qualify for the EV tax credit once the IRS issues its guidance due to being above the 55K MSRP cap for cars and 80K MSRP cap for trucks. The Senate has voted to pass the Inflation Reduction Act which includes nearly 400 billion over 10 years in funding for climate.

A new tax credit worth a maximum 4000 for used electric vehicles would be implemented. Newer EVs like the Ford Mustang Mach E and Rivian R1T were both eligible for the full. The tax credit for electric vehicles is worth up to 7500 for the purchase of a new.

The new tax credits replace the old incentive. Written by Sherin Shibu Contributor on Sept.

Fred Lambert On Twitter Here S A More Detailed Look At The Ev Tax Credit Reform That The Senate Is Expected To Make Happen Thanks To Chris Stidham Https T Co Yhwk7mn4cv Https T Co T6rbzuwuhn Twitter

Inflation Reduction Act Ev Tax Credits Could Hurt Sales

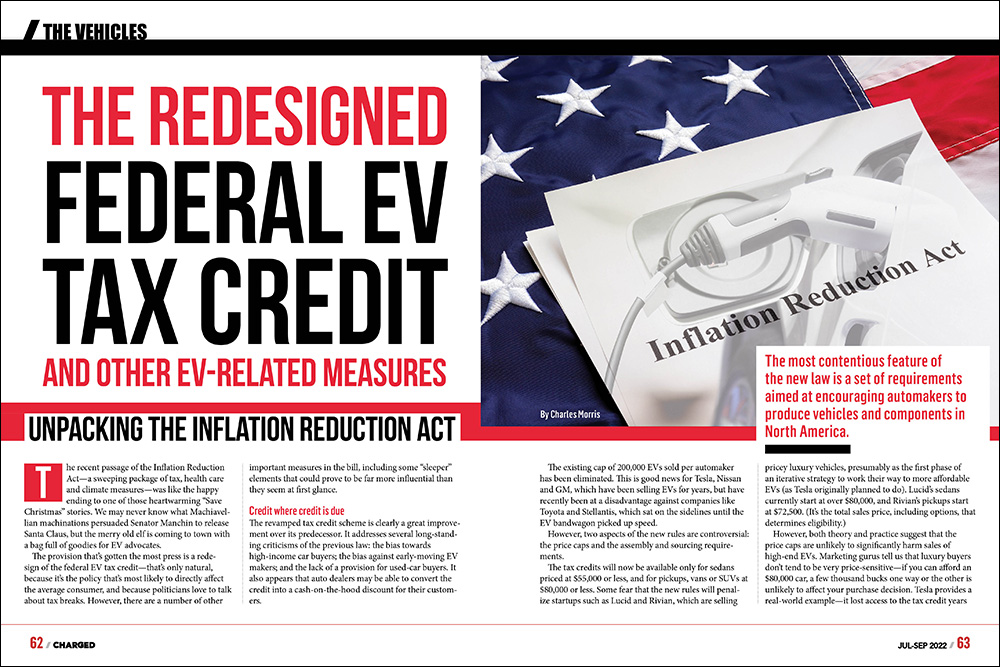

Charged Evs The Redesigned Federal Ev Tax Credit And Other Ev Related Measures Charged Evs

Official Toyota S 7 500 Federal Tax Credit Phaseout Is Underway

Toyota S Federal Ev Tax Credits Are All Dried Up

Ceos Of Gm Ford And Other Automakers Urge Congress To Lift Electric Vehicle Tax Credit Cap

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

How The New Ev Tax Credits Work

Ev Tax Credit May Be Out Of Reach For Most Consumers Roll Call

The New Electric Vehicle Tax Credits Explained Popular Science

Automakers Seek End To Ev Tax Credit Sales Cap Don T Mess With Taxes

Should Congress Lift The 200 000 Sales Ev Tax Credit Cap Cleantechnica

Ev Tax Credit Boost At Up To 12 500 Here S How The Two Versions Compare

A Complete Guide To The New Ev Tax Credit Techcrunch

New Tesla Tax Credits They Changed Everything Youtube

Automakers Want Congress To Drop The Ev Tax Credit Cap Engadget

/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Rivian.png)

New Clean Vehicle Tax Credit Plan Means Most Evs No Longer Qualify Forbes Wheels

What The Inflation Reduction Act Means For Electric Vehicles Union Of Concerned Scientists

Gm Toyota Ford Stellantis Urge For 7 500 Ev Tax Credit Cap To Be Dropped Carscoops